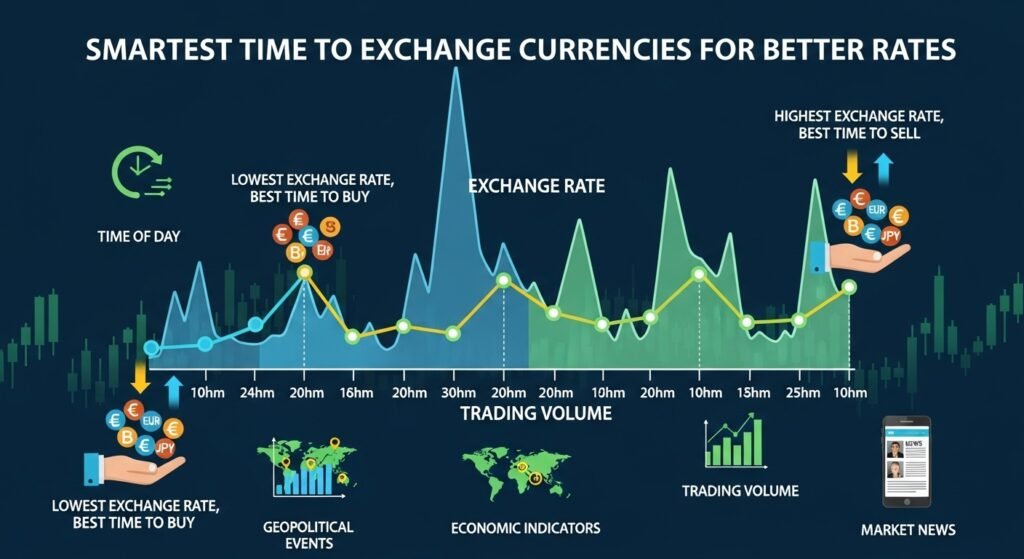

Timing currency exchanges strategically can significantly impact the amount of money received when converting between currencies. Understanding when to exchange maximizes conversion value while avoiding costly mistakes that diminish funds. Multiple factors, including market hours, economic news releases, day-of-week patterns, and seasonal cycles, determine optimal exchange timing. This comprehensive guide examines the primary timing considerations enabling informed currency exchange decisions for travelers, businesses, and international money transfers.

Daily Timing: Best Hours for Currency Exchange

The London-New York Overlap: Optimal Trading Hours

The most active forex trading period occurs during the London-New York overlap, typically 8 AM to 12 PM EST (1 PM to 5 PM GMT). This window represents the highest trading volume across global currency markets, creating optimal liquidity conditions enabling tighter spreads and more competitive rates.

During this overlap, both European and North American trading desks operate simultaneously, maximizing market participation and competition. The increased competition between providers forces them to offer better rates to attract business, directly benefiting currency exchangers.

Why Morning Hours Matter:

Morning trading hours during regular business days (8 AM to 12 PM in major financial centers) demonstrate significantly better rates compared to late afternoon or evening periods. Banks and exchange services establish their daily rates during morning hours based on opening market data, while rates often worsen toward closing time as trading activity declines.

Tokyo-London Overlap:

The Tokyo-London overlap occurring from 12:00 AM to 7:00 AM GMT demonstrates lower volatility compared to the London-New York overlap, but still offers improved rates compared to off-hours periods. Asian traders dominating this period focus on yen-related pairs, though broader currency pairs remain less competitive.

Weekly Timing: Best Days for Currency Exchange

Tuesday through Thursday: The Goldilocks Days

Financial experts unanimously recommend Tuesday through Thursday for currency exchanges, with Wednesday recognized as optimal. These midweek days balance activity level and stability, enabling favorable rates without excessive volatility.

Why Tuesday-Thursday Works Best:

Market Stability: Tuesday opens after Monday’s volatile response to weekend news, but maintains sufficient trading activity

Data Release Timing: Major economic data releases typically occur Tuesday-Thursday, already reflected in rates

Lower Weekend Anxiety: The market functions beyond weekend-driven uncertainty without approaching Friday’s position-closing volatility

Competitive Pressure: Maximum bank and exchange service competition occurs midweek, forcing competitive pricing

Why Mondays Underperform:

Monday mornings experience elevated volatility as markets respond to weekend news, geopolitical developments, or corporate announcements. Currency traders adjust positions based on accumulated information, creating unpredictable rate swings unfavorable for exchangers.

Mondays also feature lower initial trading volume compared to established midweek activity, potentially offering less competitive rates.

Why Fridays Are Problematic:

Friday rates deteriorate substantially as traders “square positions”—closing out holdings before weekends and account cutoffs. This position-closing behavior drives artificial volatility unrelated to economic fundamentals.

Additionally, Friday closes the primary institutional trading week. Weekend-approaching uncertainty causes banks to widen spreads, protecting against Monday opening surprises.

Avoiding the Worst Times for Currency Exchange

Weekends: The Worst Period

Weekend currency exchanges demonstrate dramatically worse rates compared to weekday conversions. The forex market closes completely on weekends, preventing real-time rate updates.

Without market-based pricing, banks and exchange services apply substantially higher margins to protect against unknown Monday opening rates. These protection margins typically add 2-4% to standard spreads, causing significant losses on conversions.

Holidays and Bank Closures:

Currency exchanges on holidays (Christmas, New Year, Thanksgiving, etc.) similarly feature elevated margins. Holiday-period exchanges demonstrate 3-5% additional costs compared to normal trading days.

Late Evening and Night Hours:

Evening and nighttime currency exchanges suffer from reduced trading activity and lower market liquidity. Fewer traders operating during off-hours reduces competition, enabling providers to widen spreads and apply higher markups.

Market Session Characteristics

Tokyo Session (Asian Session):

Hours: 3:00 AM – 12:00 PM GMT

Volume: Lower compared to London/New York

Characteristics: Focuses on yen pairs, lower volatility

Best for: JPY conversions

London Session (European Session):

Hours: 8:00 AM – 5:00 PM GMT

Volume: Highest volume period (~35% of daily trading)

Characteristics: Highest volatility, best liquidity for major pairs

Best for: EUR, GBP conversions

New York Session (US Session):

Hours: 1:00 PM – 10:00 PM GMT

Volume: Second-highest volume period

Characteristics: Strong volatility, interacts with the London close

Best for: USD conversions, major pairs

Sydney Session:

Hours: 10:00 PM GMT – 7:00 AM GMT (previous day)

Volume: Lowest volume period

Characteristics: Low volatility, few major announcements

Best for: AUD conversions only

Planning Currency Exchanges: Timing Framework

Advance Planning Timeline:

Optimal currency exchange timing involves 1-3 weeks of planning before travel or transfers. This advanced timeline enables:

Monitoring rate trend, identifying favorable movements

Comparing multiple provider rates

Avoiding urgent last-minute conversions

Capturing favorable rates before departures

Flexible transaction timing

Waiting until arrival or urgent deadlines forces reliance on airport or emergency exchange services charging premium rates (5-10% above standard rates).

Rate Monitoring Strategy:

Begin monitoring your currency pair 2-3 weeks before the needed conversion. Set rate alerts through online platforms, notifying you when rates reach predetermined favorable levels. This systematic monitoring enables executing conversions when conditions are optimized.

Economic News and Rate Volatility

Avoiding Central Bank Announcements:

Central bank monetary policy decisions create dramatic rate swings immediately following announcements. Federal Reserve interest rate decisions, European Central Bank policy statements, and Bank of Japan announcements typically trigger 0.5-2% rate movements within minutes.

Prudent exchangers avoid converting within 24 hours of scheduled central bank announcements, as post-announcement volatility creates unpredictable, often unfavorable rates.

Employment and Inflation Data Releases:

Major economic indicators, including US employment reports, inflation data, and GDP announcements, create significant rate movements. The US jobs report (first Friday of each month) historically drives 0.3-1% forex movements.

Plan currency exchanges, avoiding these known data-release dates.

Earnings Season and Corporate Reporting:

Corporate earnings seasons (January, April, July, October) occasionally trigger volatility as companies rebalance international currency positions. This effect proves less pronounced than central bank announcements but warrants consideration for sensitive timing.

Seasonal Timing Considerations

Peak Travel Seasons:

Peak travel periods (December holidays, July summer, spring breaks) generate elevated currency demand, driving exchange rates unfavorably for travelers. Tourism demand strengthens local currencies in popular destinations, reducing conversion value.

Exchanging 2-3 weeks before peak seasons captures better rates versus waiting until the travel season peak.

Fiscal Year-Ends:

Corporate fiscal year-ends (March for Japan, June for the US, and December globally) often drive temporary currency movements as companies settle international accounts. Planning major conversions, avoiding these quarter-endings, can improve rates.

Agricultural Seasons:

Countries dependent on agriculture (Canada grain, Australia wool, New Zealand dairy) experience seasonal currency variations following harvests. Strong harvest periods strengthen agricultural-export-dependent currencies, creating favorable conversion windows for those currencies.

Practical Exchange Timing Strategy

Step 1: Begin Monitoring (3 weeks before conversion)

Start tracking your currency pair’s daily movements through XE.com, OANDA, or your bank’s rate history. Observe normal fluctuation ranges and recent trends.

Step 2: Set Alert Levels (2-3 weeks before conversion)

Establish acceptable rate levels triggering conversion execution. For instance, if EUR/USD currently trades s 1.16, you might set a 1.17 target representing favorable conditions.

Step 3: Identify Optimal Days (1-2 weeks before conversion)

Identify upcoming favorable days, avoiding Mondays, Fridays, holidays, and major economic announcements. Plan conversion for Tuesday-Thursday during London-New York overlap (8 AM-12 PM EST).

Step 4: Monitor Final Week

During the conversion’s final week, closely track rates and news. If rates reach your target, execute the conversion. If they don’t, execute by your deadline regardless of capturing pre-set favorable conditions versus waiting indefinitely.

Step 5: Choose Optimal Provider

Select providers offering competitive rates during the chosen conversion timing. Avoid airport exchanges and late-evening transactions.

Where to Exchange: Timing Implications

Best Providers During Optimal Times:

Online Money Transfer Services: Best rates during normal business hours (London-New York overlap preferred). Services like Wise, Remitly, and OFX typically offer mid-market rates with minimal markups.

Banks: Competitive rates during business hours (9 AM-5 PM weekdays). After-hours banking involves higher spreads.

Currency Exchange Offices: Competitive rates during midweek business hours, but deteriorate evenings and weekends

Airport Exchanges: Worst rates consistently, regardless of timing. Avoid entirely if possible.

Online vs Physical Locations:

Online money transfer services often offer superior rates compared to physical locations because 24/7 operations don’t require midweek/midday restrictions. However, even online services benefit from submitting conversion requests during peak forex trading hours when their backend execution occurs at optimal market times.

Real-World Timing Example

Scenario: Converting $5,000 USD to EUR before European vacation

Timeline:

Week 1 (3 weeks pre-departure): Begin monitoring EUR/USD through XE.com. Current rate: 1.1628 USD per EUR. Set target: 1.17 USD per EUR, representinga 0.5% improvement.

Week 2 (2 weeks pre-departure): Week-long monitoring shows rates fluctuating 1.1500-1.1750. Wednesday rates typically 1.1620-1.1660. Identify Wednesday during the London-New York overlap as the conversion day.

Week 3 (1 week pre-departure): Final monitoring confirms Wednesday again shows 1.1640 average. Submit conversion on Wednesday morning (10 AM EST) through Wise for rate lock.

Results:

Rate obtained: 1.1640 (better than average)

EUR received: 4,295 EUR (vs 4,287 EUR at the average 1.1628 rate)

Savings: €8 or approximately 0.2% improvement through timing

While 0.2% may seem modest, this accumulates substantially on large transactions.

Conclusion

The best time to exchange currencies combines multiple timing factors. Optimal days involve Tuesday through Thursday, with Wednesday representing peak performance. Optimal hours occur during London-New York overlap (8 AM-12 PM EST) when trading volume maximizes, competition intensifies, and spreads tighten.

Plan currency exchanges 1-3 weeks in advance, avoiding Mondays, Fridays, weekends, holidays, and major economic announcements. Monitor rates through this period, setting alert levels, and capturing favorable movements. Execute conversions through competitive providers during identified optimal windows.

While individual transaction timing improvements appear modest (0.5-2%), the cumulative impact across multiple conversions proves substantial. Disciplined timing strategy saves 3-5% annually for active international business operators and frequent travelers.

Remember, the perfect rate rarely materializes. Instead, aim for “good enough” rates during established optimal periods rather than waiting indefinitely for theoretical perfection, which often never arrives.