The Euro maintains critical importance as an international reserve currency used in international transactions throughout the Middle East. Understanding how the Euro exchanges against major Arab currencies enables informed financial decisions for travelers, businesses, investors, and individuals conducting cross-border transactions. The Euro’s value against Arab currencies fluctuates based on economic conditions, monetary policies, and global market dynamics affecting both Europe and Arab nations.

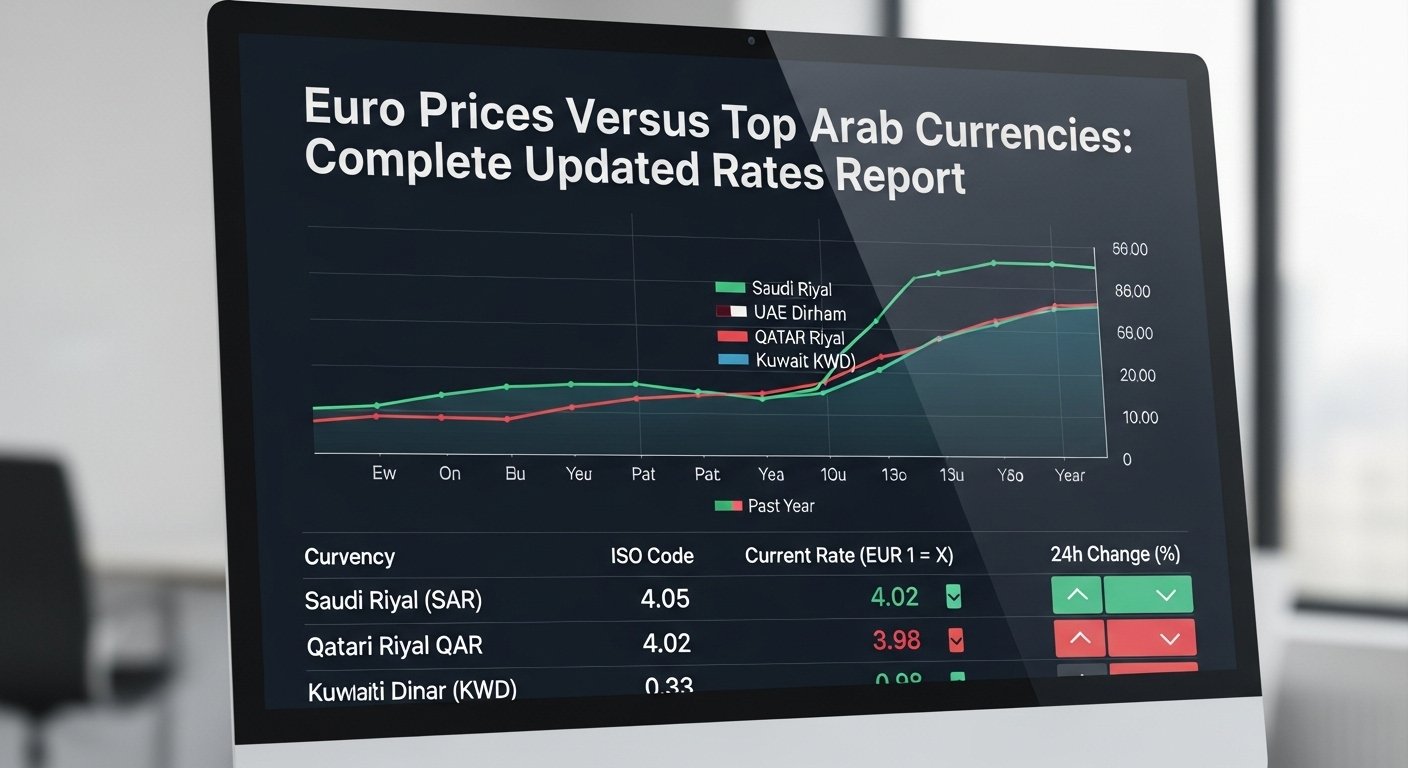

Current Euro Exchange Rates Against Top Arab Currencies

As of November 15, 2025, the Euro exchanges at varying rates against major Arab currencies:

EUR to Top Arab Currencies Current Rates:

1 EUR = 4.27 AED (United Arab Emirates Dirham)

1 EUR = 4.37 SAR (Saudi Arabian Riyal)

1 EUR = 54.59 EGP (Egyptian Pound)

1 EUR = approximately 1.38 KWD (Kuwaiti Dinar – calculated)

1 EUR = approximately 5.07 QAR (Qatari Riyal – calculated)

These rates represent current mid-market conversions reflecting true exchange values without provider markups.

Detailed Euro Conversion Tables

EUR to AED (United Arab Emirates Dirham) – Rate: 1 EUR = 4.27 AED

| EUR | AED |

|---|---|

| 1 | 4.27 |

| 5 | 21.34 |

| 10 | 42.68 |

| 25 | 106.68 |

| 50 | 213.37 |

| 100 | 426.74 |

| 500 | 2,133.68 |

| 1,000 | 4,267.36 |

EUR to SAR (Saudi Arabian Riyal) – Rate: 1 EUR = 4.37 SAR

| EUR | SAR |

|---|---|

| 1 | 4.37 |

| 5 | 21.83 |

| 10 | 43.65 |

| 25 | 109.13 |

| 50 | 218.26 |

| 100 | 436.52 |

| 500 | 2,182.59 |

| 1,000 | 4,365.19 |

EUR to EGP (Egyptian Pound) – Rate: 1 EUR = 54.59 EGP

| EUR | EGP |

|---|---|

| 1 | 54.59 |

| 5 | 272.93 |

| 10 | 545.86 |

| 25 | 1,364.65 |

| 50 | 2,729.30 |

| 100 | 5,458.60 |

| 500 | 27,292.98 |

| 1,000 | 54,585.72 |

Understanding Arab Currency Dynamics

United Arab Emirates Dirham (AED)

The AED maintains a fixed peg to the US Dollar at 3.6725 AED per 1 USD. This fixed exchange rate policy reflects the UAE’s economic strategy, prioritizing currency stability. Because the AED remains pegged to the dollar, EUR to AED conversions depend entirely on Euro-to-Dollar movements. When the Euro strengthens against the dollar, the AED weakens proportionally against the Euro.

Saudi Arabian Riyal (SAR)

The Saudi Riyal maintains the world’s longest continuous fixed exchange rate peg at 3.75 SAR per 1 USD since 1986. This fixed relationship reflects Saudi Arabia’s oil-dependent economy and the lobal oil market dollar denomination. EUR to SAR conversions remain directly influenced by Euro-to-Dollar dynamics. The riyal’s stability reflects Saudi Arabia’s substantial foreign exchange reserves supporting the peg indefinitely.

Egyptian Pound (EGP)

The Egyptian Pound has operated under a floating exchange rate system since 2016. Unlike Gulf currencies with fixed dollar pegs, the pound fluctuates based on Egyptian economic conditions, monetary policy, inflation dynamics, and capital flow changes. EUR to EGP conversions experience volatility reflecting Egyptian Pound volatility against the dollar. The pound strengthened approximately 5% from April 2025 through October 2025 as economic conditions improved.

Historical Euro Exchange Rate Trends Against Arab Currencies

EUR to EGP Historical Pattern (2025):

The Euro-to-Egyptian Pound rate exhibited substantial volatility throughout 2025:

Highest Rate: 58.25 EGP per EUR (May 2025)

Lowest Rate: 51.77 EGP per EUR (January 2025)

Average Rate: 55.66 EGP per EUR

Current (November 15): 54.59 EGP per EUR

This volatility reflects the Egyptian pound devaluation earlier in 2025, following economic pressures, subsequently followed by appreciation during economic stabilization efforts through the autumn months.

EUR to AED and EUR to SAR Stability:

Due to fixed dollar pegs maintaining AED and SAR stability, EUR to AED and EUR to SAR rates show minimal volatility. The 30-day trading range for EUR to AED remains narrow between 4.22 and 4.30 AED, reflecting only Euro-dollar fluctuations rather than underlying currency stress.

Factors Influencing Euro-Arab Currency Exchange Rates

Multiple economic and geopolitical factors influence exchange rate movements between the Euro and Arab currencies.

Euro Economic Strength

European Central Bank monetary policy decisions directly impact Euro valuations. Higher ECB interest rates strengthen the Euro, enabling greater purchasing power against Arab currencies. Lower rates weaken the Euro. Recent ECB rate cuts throughout 2025 influenced Euro weakness against Arab currencies during the summer and autumn months.

Oil Price Dynamics

Arab economies depend substantially on petroleum export revenues. Rising global oil prices increase Arab currency valuations through increased export revenues. Declining oil prices pressure Arab currencies downward. Oil-dependent economies, particularly sensitive to price fluctuation, include Saudi Arabia and the UAE.

Egyptian Economic Reform Progress

Egyptian Pound valuations depend heavily on economic reform implementation. Successful reforms strengthening investor confidence support pound appreciation. Reform setbacks trigger pound depreciation. The pound’s 2025 appreciation reflected IMF reform program progress and inflation management improvements.

Global Risk Sentiment

During periods of global economic uncertainty, investors typically favor safe-haven currencies, including the Euro. Risk appetite increases direct Arab currency investment relative to the Euro. This risk sentiment fluctuation creates exchange rate volatility independent of fundamental economic conditions.

Geopolitical Stability

Regional stability affects investor confidence in Arab economies. Geopolitical risk concerns trigger capital outflow,sweakening Arab currencies. Improved stability prospects support currency appreciation relative to risk-averse alternatives like the Euro.

Real-Time Exchange Rate Tracking Methods

Multiple reliable platforms enable real-time Euro exchange rate monitoring against Arab currencies.

Online Currency Converters

Dedicatedplatformsr s including XE.com, Wise, Revolut, and exchange-rates.org, provide instant Euro conversion rates. These platforms display mid-market rates reflecting genuine conversion values without provider markups. Most updates are continuous during market hours.

Financial News Platforms

Bloomberg, Trading Economics, and financial news services publish real-time currency rates. These professional platforms serve traders and serious investors requiring current information for financial decision-making.

Bank Digital Platforms

Many banks provide online currency rate displays enabling customer rate monitoring. Bank rates typically include small markups compared to mid-market rates while remaining competitive and transparent.

Money Transfer Services

Wise, Revolut, and specialist remittance providers display current rates within applications. These services enable convenient rate checking during money transfer transactions.

Quick Comparative Analysis: EUR vs USD in Arab Markets

Understanding how the Euro performs relative to the US Dollar in Arab markets provides valuable context.

The US Dollar maintains stronger purchasing power than the Euro against Arab currencies due to structural factors:

Fixed Pegs: AED and SAR maintain fixed dollar pegs while the Euro floats freely, reducing dollar conversion needs.

Oil Markets: Global petroleum trades primarily in dollars, creating natural dollar demand in Arab oil-exporting nations.

Financial Assets: Arab foreign exchange reserves are predominantly denominated in dollars, preferring dollar stability over Euro volatility.

Investment Flows: US financial markets attract significant Arab institutional investment compared to European markets.

Best Methods for EUR to Arab Currency Conversions

Multiple exchange channels offer distinct advantages depending on transaction type and preferences.

Online Money Transfer Services

Specialized platforms, including Wise, Revolut, and Remit,y provide competitive rates with transparent fee structures. These services typically charge flat fees rather than percentage markups, proving economical for various transaction sizes.

Wise maintains particularly competitive Euro-Arab currency rates with minimal fees. Revolut offers fee-free weekday conversions for active account holders.

European and Arab Banks

Commercial banks throughout Europe and Arab nations offer EUR conversions for customers. Banks provide reliable service with institutional credibility. Rates typically remain competitive for customers maintaining account relationships.

Currency Exchange Offices

Dedicated exchange establishments provide instant conversion with competitive rates. These specialized providers often offer better rates than general-purpose banks due tto their o currency exchange focus.

ATM Withdrawals

International ATMs throughout Arab nations enable direct Arab currency withdrawal using European debit cards. ATM conversions typically reflect competitive mid-market rates with fees depending on home bank policies.

Tax and Legal Considerations

Individuals and businesses conducting Euro-Arab currency conversions should understand applicable tax and legal requirements.

EU Tax Requirements

EU residents conducting personal Euro conversions face minimal tax implications. Business conversions require proper documentation and may trigger corporate tax considerations.

Arab Country Regulations

Arab nations permit reasonable personal currency exchanges without special documentation. Large transfers may require legitimate source documentation. Consult the specific country Central Bank guidelines for transaction thresholds.

Resident Requirements

Expatriate residents conducting regular conversions should maintain proper documentation supporting transaction legitimacy and tax compliance.

Future Exchange Rate Outlook

Financial institutions provide varied Euro-Arab currency forecasts reflecting different analytical perspectives.

EUR to AED Outlook

EUR to AED rates should remain stable near current levels pending Euro-dollar dynamics. The fixed dirham peg ensures AED stability, with EUR fluctuations determining rate movements. EUR to AED should remain within a 4.10-4.40 AED range through 2026.

EUR to SAR Forecast

Similar to AED, EUR to SAR should stabilize near the current 4.37 SAR levels. The Saudi riyal’s fixed peg ensures predictability. EUR to SAR should trade within a 4.20-4.55 SAR range pending Euro-dollar movements.

EUR to EGP Projection

Egyptian Pound valuations depend heavily on reform progress and inflation management. Continued economic stabilization supports pound appreciation. EUR to EGP could reach 50-53 EGP levels if reforms advance successfully. Economic setbacks could trigger depreciation toward 56-58 EGP levels.

Conclusion

Euro exchange rates against Arab currencies reflect distinct economic structures and monetary policy arrangements. Fixed-peg Arab currencies like the AED and SAR maintain remarkable stability, with EUR conversions depending entirely on Euro-dollar dynamics. The floating Egyptian Pound exhibits volatility reflecting economic conditions, inflation dynamics, and reform implementation success.

Current November 2025 rates position the Euro at 4.27 AED, 4.37 SAR, and 54.59 EGP. These rates enable straightforward conversion calculations for personal, business, and investment purposes. Multiple reliable platforms provide real-time rate tracking supporting informed conversion decisions.

Strategic provider selection combined with rate monitoring through established platforms maximizes conversion value while minimizing fees. Whether converting modest personal amounts or managing substantial business transactions, understanding current Euro rates against Arab currencies and monitoring rate trends enables efficient financial decision-making, supporting your international objectives.